Ajay Kathrani reflects on the results of the UK’s first Immersive benchmarking survey, including:

- Profitability

- Staff recruitment and costs

- Winning new business

Knowledge is the lifeline of any business – it’s a cliché for good reason. Determining whether your proposal win-rates, cost drivers, and in-house skill sets are in line with others in the sector can prove decisive to your business strategy. In rapidly emerging economic sectors like immersive technologies, such information is vital. It can reduce commercial risks when launching new products and services, inform talent compensation strategies, and help shape future development plans.

To help immersive businesses get a handle on these issues, Immerse UK has recently completed its first annual benchmarking survey. The majority of respondents were SMEs, and two-thirds were micro businesses, supporting our initial assumptions that it is this cohort of early stage companies that are likely to benefit most from benchmarking information. Some larger buyers of immersive content did participate in the survey, but most respondents specialised in content production, or platform and software development. The results have highlighted a range of arresting, and sometimes surprising, insights.

Survey findings on business fundamentals and the future outlook for immersive media indicate a competitive, but healthy working environment with positive growth prospects. Most businesses were working on fewer than five commercial immersive projects, but a fifth of all respondents had more than ten projects in the pipeline. Average revenue growth rates were circa 10% on the preceding year, but over a quarter of businesses reported a 50% increase in annual revenue. While a third of all businesses did not report any profits, a fifth had profits of greater than 20%.

The success rates for winning new work were also found to be better than other sectors, with over half of respondents reporting a win-rate of 20% for immersive content and technology proposals they had submitted, and a third reporting win-rates of 50%. Perhaps most reassuringly, the results show that at least half of all respondents are undertaking business planning three to five years out.

While this survey did not make a distinction between differing immersive VR, AR and MR technologies or their application areas, the overall confidence in future growth of the broader sector corresponds well with information emanating from other Immerse UK research.

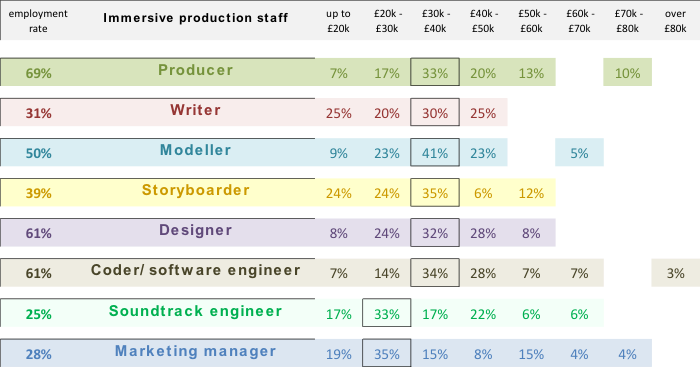

Survey findings on skills, staff costs and recruitment were a little more mixed. The table below seeks to illustrate findings on prevalent salary ranges for eight key immersive staff categories. Infographics are often style over substance, so this is an attempt to reverse that trend…

The employment rate % for these roles shows the proportion of survey respondents with these positions in their organisations. Interestingly, just over half of respondents did not have written job descriptions in place.

The lower employment rate for writers, story-boarders and soundtrack engineers is perhaps an indication that these skill-sets are more often provided by freelancers. And the low rate for marketing managers is likely best explained by the micro business constituents of the survey as noted earlier in this commentary. The %s shown for each staff type under the eight salary ranges indicates the pay level of staff employed by survey respondents. As such these represent mode salaries. With the exception of a few obvious outliers, there is a clear clustering around the £30k to £40k range, arguably lower than expected, but possibly indicating shared awareness of market compensation levels. The skew towards the lower end of the salary ranges also suggests that in the absence of formal sectoral qualifications, many early career immersive technology and content staff are trained on the job. This is supported by the survey findings where 40% of respondents said the focus of training offered to staff is on internal learning around real-world projects.

Surprisingly, survey respondents did not report any significant issues accessing skills: just under half of all businesses stated that recruiting the right staff took between one to three months and only a small minority said it took longer than six months. This contradicts anecdotal evidence and findings from some of our other research and is clearly an area warranting further research.

We hope that sharing these findings from Immerse UK’s first annual benchmarking survey has provided some useful and additional business intelligence for immersive technology and content practitioners. Please do get in touch if you have feedback, or have ideas or suggestions for the focus of surveys in future years. Contact us at enquiries@immerseuk.org