What were the key trends in investment in the immersive tech sector in 2018? The Accelerator Network’s director, Katie Lewis highlights the story behind the statistics and discusses the challenges and opportunities for both investors and companies in the sector in the year ahead.

By Bernadette Fallon

Has the trend for a drop in investment in 2018 been halted by a light at the end of the (Q4) tunnel?

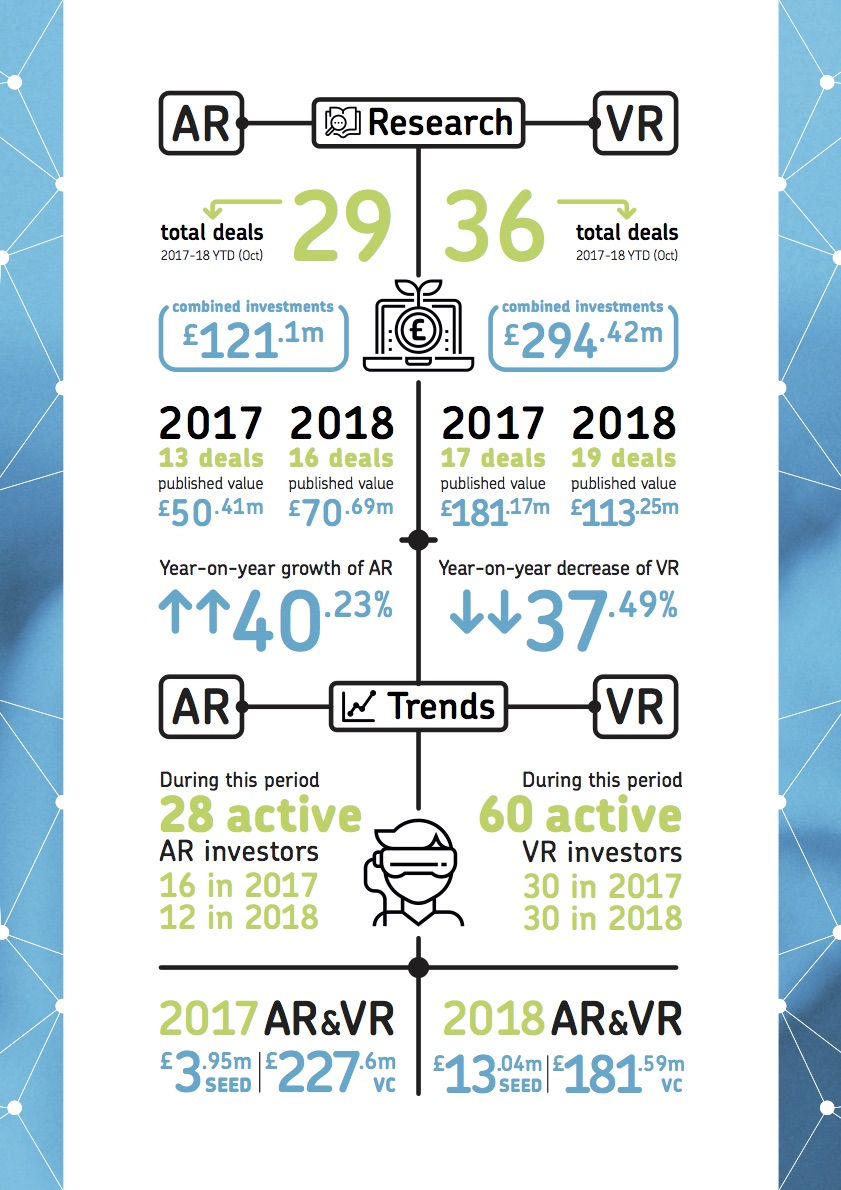

The Accelerator Network director Katie Lewis crunches the numbers against the backdrop of Immerse UK’s investment infographic and the latest Beauhurst report, and advises how to be investor-ready in an uncertain market.

Immersive technology deals are dropping in the UK. After a record year in 2017, VR investment is down 37% YOY, from £181.17m to £113.25m in 2018. But the stats don’t paint the full picture. While the investment amount has dropped, the number of deals has actually increased, representing a rise in investment opportunities last year. The investors are still coming, they are just investing smaller.

And the picture at the end of last year may yet turn out to buck the overall trend. “What the Immerse UK investment infographic and overall international overview demonstrate is that investment could well be picking up,” explains The Accelerator Network’s Katie Lewis. “At the end of last year, in Q4, we started to see the investment activity increasing, but it wasn’t enough to compensate for the drop offs in Qs 1 to 3.”

The picture is much more robust in the AR landscape, with investment increasing 40% YOY from £50.41m in 2017 to £70.69m in 2018. Deal numbers were up here as well, from 13 to 16.

But will Q4’s rising tide continue into 2019 and beyond?

It’s impossible to predict, says Katie. But she will say this.

“Whether it’s augmented or virtual reality, companies are much more interested in the type of problem that the technology is solving, rather than the technology itself. It’s all about the user case and the need for businesses to articulate how their solutions address user problems.”

This may, she suggests, be the reason for AR’s stronger performance in the industry. “Is augmented demonstrating a strong user case when it comes to solving the challenges out there? Perhaps virtual is not quite hitting the same point with investors and they are recognising the risk by investing smaller amounts and waiting to see progress, rather than committing to larger size seed rounds.”

Because the picture is slightly more worrying at seed level with overall equity deals into companies at the seed stage down by 15%, back to 2014 levels say Beauhurst.

With seed stage decline inevitably leading to a drop in investable companies operating at venture and growth stages, is this a cause for concern?

Not necessarily. The Deal: Equity Investment in the UK 2018 by Beauhurst claims two reasons why this drop in seed investment may be short term only.

“Firstly, the seed-stage is the riskiest stage and therefore most likely to be impacted by macroeconomic uncertainty. There is no doubt that these are uncertain times: for early-stage investors as much as anyone else.”

“Secondly, if we look at the types of investors completing these deals, we see the number of deals with angel networks participating fall the most. Compared with 2017, angel network investments had fallen by 35%. Angel networks are perhaps the investors with the greatest flexibility to adjust their investment preferences on an ad hoc basis as political events develop. These are the investors most likely to be deferring investment until there is greater clarity on what will happen next.”

“Once businesses are through the seed stage, the impact of this volatile external landscape is less of an issue. “VCs have a mandate to spend money to make investments and are not as impacted as individuals investing their own cash,” says Katie. “There is always a selected group of people with an ultra-high net worth who are taking the risks and reaping the rewards. Others will be sensitive to risk and will reduce high risk investment to be more protective of their own portfolio.”

Looking at the international picture, the elements are broadly the same.

Global investment, in terms of both deal volume and deal size, was down for the first three-quarters of 2018 with a 10% overall decrease, but both deal volume and value returned to a 2-year average by Q4. According to Digi-Capital, globally over $6 billion was raised across AR/VR/computer vision in 2018, driven by large, late-stage deals in China. And, as with the UK, the stages which have seen the most variance are pre-seed and seed deals. “The next six months will determine whether or not this return to stability is a long-term trend,” Digi-Capital says.

When it comes to top performing categories, core tech leads the way in terms of the investment value.

In this category, Digi-Capital has highlighted the strength of Chinese companies crossing over between computer vision and AR, rather than AR pureplays. “Even removing these crossover investments from the numbers, there was still significant investment with Chinese companies in AR advertising, lifestyle and smartglasses categories completing $100 million plus deals.”

In the West, smartglasses company Magic Leap did the biggest deal with its $461m round, and mobile AR game company Niantic raised $245m. Other deals ranged from hundreds of thousands to tens of millions of dollars across over 20 AR/VR categories.

Strong sectors in the UK continue to be medical and training/education, confirms Katie, continuing the trend for growth in these areas.

In the wider equity market, the Beauhurst report highlights the ongoing strength of the fintech sector, which secured 10% of 2018’s deals. However, “the adtech bubble appears to have well and truly burst, with deal numbers falling by 48%, and surpassed by blockchain for the first time”.

So, in an uncertain investor market, what can UK businesses do to be investment ready?

A substantial amount, according to Katie who, through her role at The Accelerator Network, delivers support for early stage businesses from ideation through proof of concept to investment readiness. Working with over 1,000 start-ups and scale-ups each year, their programmes include pre-accelerator and accelerator programmes, as well as AR/VR investment readiness bootcamps.

From an investment readiness perspective, it’s essential that companies prepare all of their business plans, financials, presentation decks, pitch decks and executive summaries alongside their data rooms for due diligence, explains Katie. This is important for a number of key reasons.

“If they prepare all of this material before taking their business out to investors, it means they can validate a lot of their assumptions, sense check their business plan and the way they are positioning the growth of their business. It encourages them to go out and get first-hand feedback from their customers, potential customers and any other partners, which leads to them having a much more robust plan.”

It also allows a company to fully address all of their key business areas – looking at the problem they’re addressing, the solution they’re building, the target market they’re focused on and their differentiation in that market. They can establish how they’re reaching that market, as well as their go to market strategy and sales process. It involves closely looking at the team involved and how they’re going to be resourcing and delivering what they’re promising. This builds a strong business and revenue model and forecasts the investment opportunity.

“It’s all about a company being able to put their story across to investors and think about it from the investors point of view,” says Katie. “This kind of clarity comes through if you have dived into every area of your business and applied all of the above thinking.”

She advises there is one key issue to avoid when pitching to investors. “The biggest pitfall we see companies fall into is that they see the investment being all around their snazzy technology, around their solution. But really the investment is much more around the opportunity for a return for the investor.”

It’s essential, she continues, to be able to articulate that opportunity clearly. Think about your exit, she advises, what does that look like, how will it happen, will it be through a trade sale, the most common route in the UK.

“Think about who might buy your company, who is currently acquiring in your area. That will give an investor confidence that there has already been M&A activity in this space. It’s not about being able to predict the future but it is about being able to demonstrate some rational logic that you are creating value in your company that will be attractive for an acquisition.”

Having these conversations before they are needed or expected shows a maturity in thinking, she explains, which will set your company above other start-ups who may just be pitching blindly for the cash.

And finally: “Network at events where you’re more likely to bump into your ideal investor rather than only attending start-up focused events. Build relationships before you need them.”

It’s important advice in an uncertain market. But with potential growth on the horizon, it’s still all to play for as we move into 2019.

The infographic

You might also be interested in

You might also be interested in

-

-

- Finding out more about the Investment Accelerator

- Reading other investor related blogs from Station12’s Patrick Bradley. Vive X’s Dave Haynes and the Mercia Technologies team

- Downloading our Investment Landscape Infographic

-